A coworker asked me what changed from the 2013 tax rates, so it’s time to do an update.

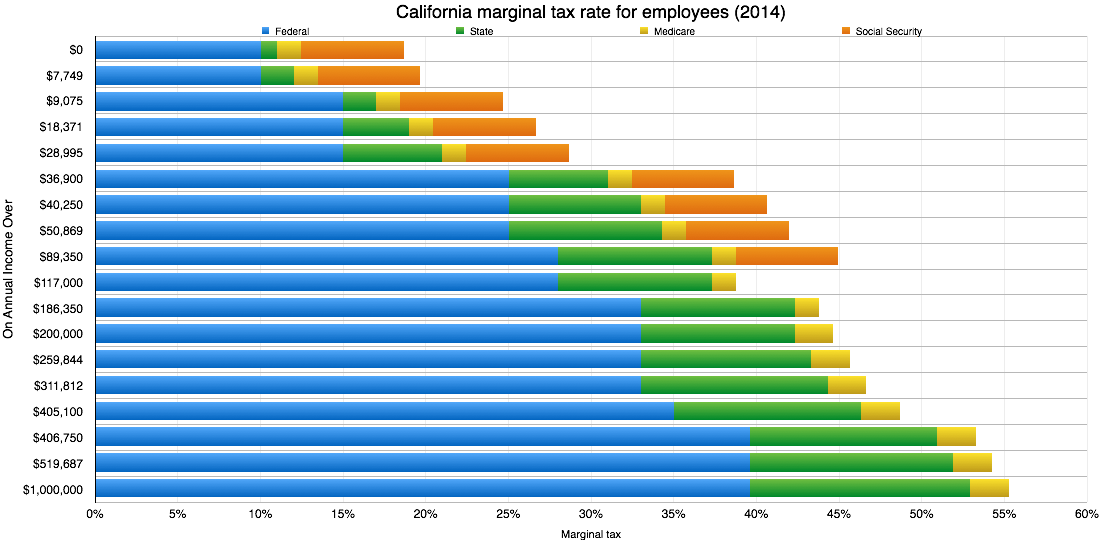

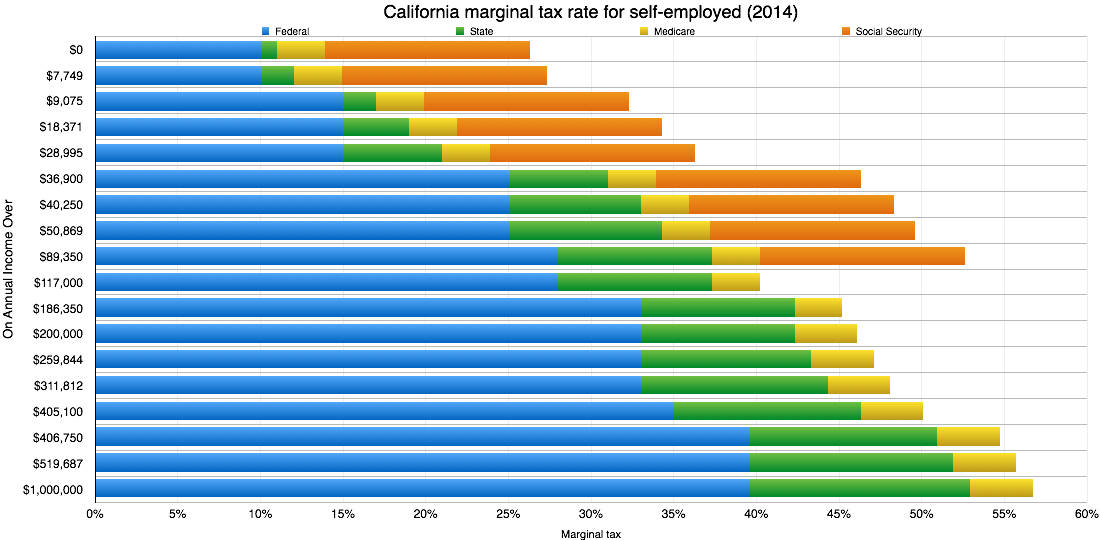

The charts below are the 2014 marginal tax rates for a single tax filer - one for employees and one for self employed. If you’re earning over $7,749 per year (but less than $9,075), you can see how much tax you’d pay on each additional dollar you make by looking at the $7,749 row. For those of you who want to see the exact percentages, the images link to a (less pretty) version of the charts that shows percentages.

My sources were the California Franchise Tax Board, the IRS Rev. Proc 2013-35 Section 1(c) and the Social Security Administration publication 05-10003.