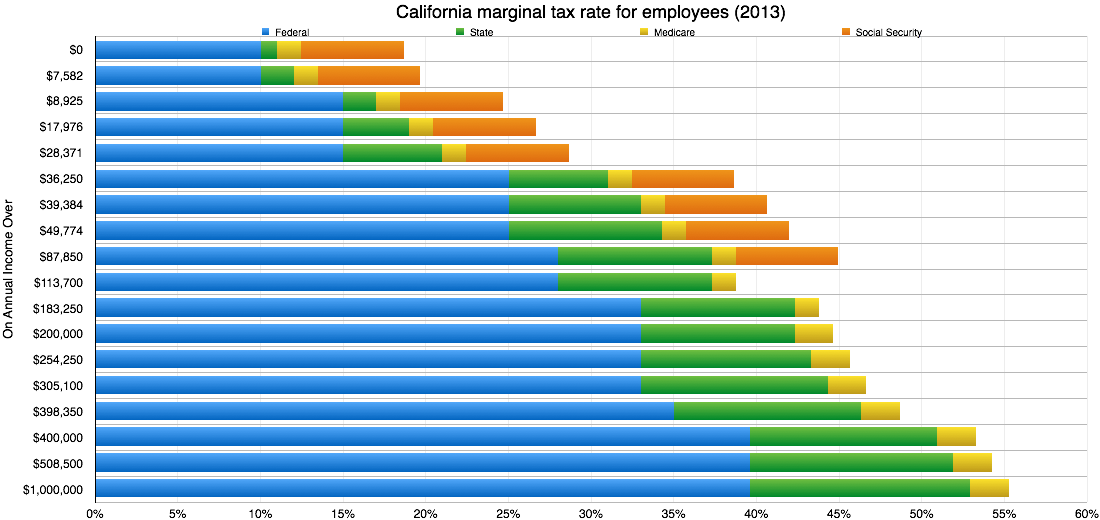

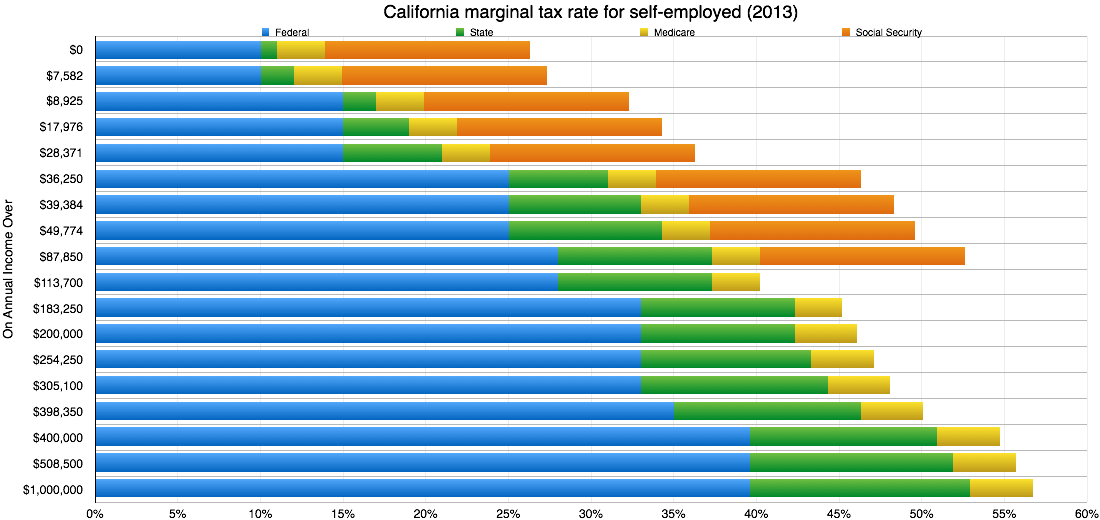

It’s that time of year - you know, the time when you start thinking about beginning to consider doing taxes. I’m far ahead of the curve and actually looked at one of my tax documents already, and wondered about the various additional taxes (Medicare, Social Security) and how big of a role they play in your tax rate.

Since most tax is computed marginally (eg, for every dollar past a threshold you pay a new tax percentage), I made two charts of marginal tax rates for California residents in 2013. One is for employees, the other is for self-employed (where Medicare and Social Security taxes double).

My sources were the California Franchise Tax Board, the Tax Foundation, the IRS Additional Medicare FAQ, and the Social Security Administration.